Congresswoman Scholten’s proposal seeks to empower biogas producers and reduce greenhouse emissions across Michigan and the nation, highlighting the importance of the Biogas Tax Credit.

Agricultural Environmental Stewardship Act to Extend Key Tax Credit

WASHINGTON — Congresswoman Hillary Scholten (D-MI) and Congressman David Valadao (R-CA) introduced the Agricultural Environmental Stewardship Act of 2025, a bipartisan bill designed to extend the Section 48 Investment Tax Credit (ITC) for qualified biogas properties through December 31, 2025. This proposal follows the expiration of the tax credit at the close of 2024, a situation that left clean energy stakeholders scrambling after final guidance from the Treasury Department was issued just weeks before the deadline.

The bill, supported by the American Biogas Council and the Coalition for Renewable Natural Gas, aims to provide financial stability and regulatory clarity to biogas producers nationwide. By extending the credit, the legislation seeks to catalyze clean energy projects at landfills, wastewater treatment plants, and agricultural operations while reducing greenhouse gas emissions and lowering utility costs for American families.

Addressing a Tight Deadline for Clean Energy Stakeholders

The Section 48 ITC, originally extended through December 2024 under the Inflation Reduction Act, supports investments in clean energy infrastructure. However, final Treasury rulemaking for the credit was delayed until December 4, leaving only 27 days for projects to qualify. The narrow window created uncertainty for potential investors and stalled projects that could drive sustainable energy production.

“Extending the Sec. 48 ITC is common sense,” said Congresswoman Scholten. “If we want to secure America’s green future, we must ensure producers have the clarity necessary to make critical investments in biogas. My bill would put West Michigan’s agricultural community at the forefront of the clean energy transition, cutting emissions and lowering costs for families across the country.”

Congressman Valadao echoed this sentiment, highlighting the successes of California farmers. “Farmers in the Central Valley are already leading the way in turning agricultural waste into clean energy. Extending the ITC will help expand these efforts, diversify the energy grid, and create new income opportunities.”

The Biogas Tax Credit Helps Transform Waste into Renewable Energy

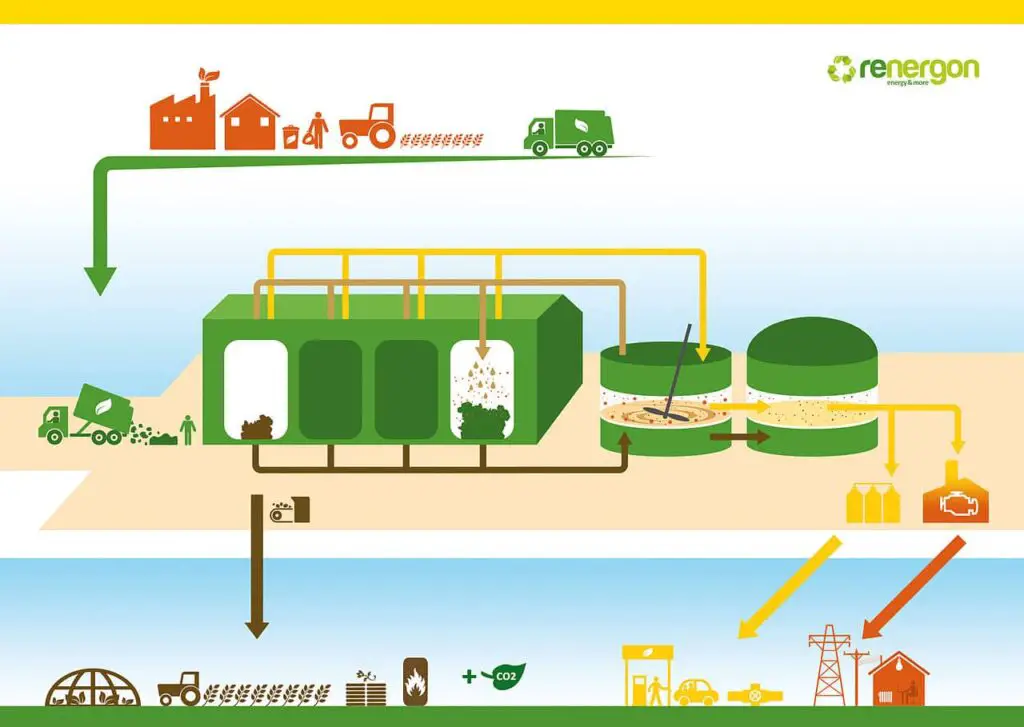

Biogas, produced from organic waste such as diverted food scraps, animal manure, and landfill emissions, offers a dual benefit of generating renewable energy while reducing methane, a potent greenhouse gas. This process supports both electric and natural gas grids and provides nutrient-rich fertilizers for agricultural use.

The proposed extension is expected to spur private investments in the sector, with millions of dollars projected to flow into rural communities nationwide. Michigan’s agricultural hubs, including those in the western region, stand to benefit significantly.

Patrick Serfass, Executive Director of the American Biogas Council, praised the bipartisan effort. “Biogas is a versatile solution to America’s growing energy demands, producing domestic energy from organic waste. Passing this legislation will unlock private investments across rural America.”

Similarly, Geoff Dietz, Executive Director of the Coalition for Renewable Natural Gas, emphasized the potential for job growth and economic expansion. “This bill will provide critical investment certainty, fostering growth in the rapidly developing alternative fuels industry.”

Local Impact: A Spotlight on Michigan

Michigan, known for its robust agricultural industry, could see substantial benefits from the legislation. West Michigan farms, landfills, and food processing facilities are positioned to become leaders in biogas production, aligning with state goals to lower greenhouse gas emissions and enhance renewable energy capabilities.

Scholten’s office noted that extending the tax credit would also help Michigan utilities meet their renewable energy standards, potentially leading to lower energy costs for consumers. With bipartisan support, the measure represents an opportunity to advance both environmental and economic goals.

Broader Context: Clean Energy Policy and Industry Challenges

The push to extend the Section 48 ITC comes as the federal government seeks to balance economic growth with aggressive climate action. The Inflation Reduction Act’s clean energy provisions have accelerated renewable projects but face implementation challenges due to regulatory delays and market uncertainties.

This legislation reflects growing momentum to solidify America’s leadership in renewable energy while addressing lingering gaps in policy execution. Stakeholders hope that timely action on the Agricultural Environmental Stewardship Act will set a precedent for smoother rollout of future clean energy initiatives.

Find More Interesting Feature Stories From ThumbWind

- Michigan Features: Unveiling the diverse and vibrant people, captivating places, and remarkable events that make the Great Lake State unique and cherished.

- Weird Political News: A sarcastic take on official news, exploring absurdities in politics while providing a humorous perspective on current events.

- Michigan News: News and events from Michigan’s Upper Thumb region, featuring local stories and impactful interviews that shape the community.

Your Turn – Like This, or Hate it – We Want To Hear From You

Please offer an insightful and thoughtful comment. We review each response. Follow us to have other feature stories fill up your email box, or check us out on Newsbreak at ThumbWind Publications.